Phoenix Buys Bitcoin Mining Equipment for $186.5 Million

Phoenix Splashes $186.5M on Crypto Mining Machines

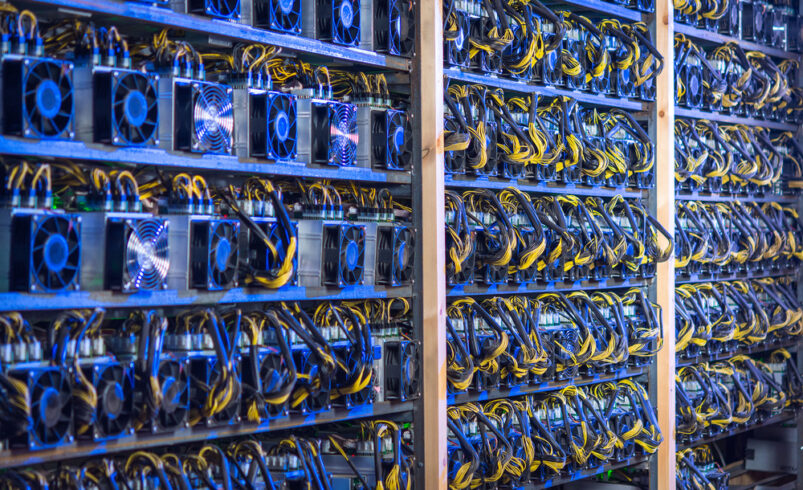

Phoenix, a popular crypto mining company listed on the Abu Dhabi securities market, has announced that it has spent more than $186 million to acquire mining machines to increase its production capacity.

Phoenix’s subsidiary, Phoenix Computer Equipment, revealed the purchase through a disclosure submitted to the Abu Dhabi Securities Exchange earlier this week. The disclosure mentioned the manufacturer of crypto mining machines, Bitmain, as the supplier of the purchased equipment.

Moreover, the disclosure stated that the two parties had already completed the necessary steps involved in the acquisition of the mining machines. Phoenix says the latest purchase would help the firm enhance its hashing power as it aims to become a global leader in the crypto mining space.

Phoenix Makes Another Massive Acquisition

Phoenix has made two significant acquisitions in less than two months. Last December, the UAE-based crypto mining firm announced it had purchased mining machines worth $380 million from WhatsMiner. The purchase marked WhatsMiner’s second-largest sale in two years.

Try GPT Definity AI today, the #1 crypto trading robot! Click here to learn more. Artificial intelligence trading robots are taking over the trading eco-system, you can join this revolution and profit from daily revenues! Get ahead of the trading game with Artificial Intelligence crypto trading software today!

That month, Phoenix became a publicly traded company, with its stock getting listed on the Abu Dhabi Securities Exchange. As of this writing, Phoenix’s stock is trading at $0.61 (2.3 UAE dirhams) and has a market capitalization of $3.92 billion (14.1 billion UAE dirhams).

Phoenix completed its IPO (Initial Public Offering) in November with an oversubscription of 30 times. At the time, the firm reported “overwhelming demand” as the over 907 million shares allocated for the IPO were purchased within a few days.

Crypto Mining Stocks Are Surging

Meanwhile, in the United States, interest in crypto mining stocks has been rising since the start of the year, according to Yahoo Finance data. On January 8th, crypto mining firms Riot and Marathon Digital posted a combined trading volume of $3.5 billion. That day, over 112 million shares of Marathon Digital’s stock, MARA, were traded. This put the crypto miner ahead of big brands like Apple, Nvidia, AMD, and Tesla, which all saw less than 100 million traded shares.

Several analysts are predicting more interest in crypto mining stocks after the Bitcoin halving in April.

Disclaimer: Mining Plus Crypto specializes in amplifying content for dozens of cryptocurrency and blockchain firms, and your company could be next on the list! For inquiries, please reach out to us through or Telegram Chat. Given the unpredictable nature of cryptocurrencies, we advise you to thoroughly research before investing. A portion of the content available on our website, including broker reviews, is paid content or content contributed by guest writers and does not necessarily represent the opinions of Mining Plus Crypto. We claim no liability for the accuracy, quality, and content of advertisements, products, or any other materials, including ad spaces displayed on our site. For a comprehensive understanding, please review our full terms and conditions, and disclaimer.