What Does Bitcoin Halving Mean for Investors?

Every 4 years, Bitcoin miners prepare themselves to see their mining rewards reduced by half in an event known as halving. In less than 100 days, another halving event will happen. But does it mean anything to Bitcoin investors? Should they pay attention? Let’s get the answers in this article.

Bitcoin Halving: The Bolts and the Nuts

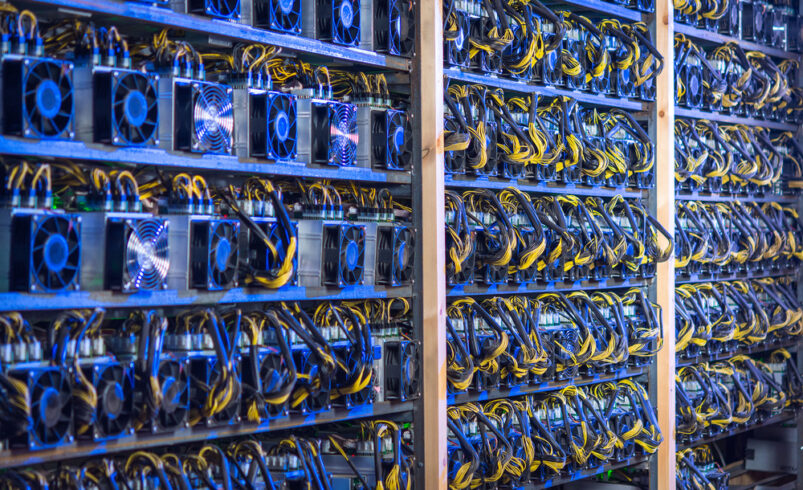

Once Bitcoin halving happens in April this year, miners will see their rewards drop from 6.25 BTC to 3.125 BTC for every block they add to the Bitcoin network. The reason for this reduction is to minimize the rate at which new BTC coins enter the circulating supply.

So, does anyone know the exact date when Bitcoin halving will happen? No! The event will only occur after 210,000 blocks have been mined. Many anticipate that the 210,000th will be mined around April.

Meanwhile, some crypto analysts believe this year’s Bitcoin halving won’t be the same as the previous ones due to more people talking about the event. There has been growing interest in the crypto industry from big institutions over the past few months.

Try GPT Definity AI today, the #1 crypto trading robot! Click here to learn more. Artificial intelligence trading robots are taking over the trading eco-system, you can join this revolution and profit from daily revenues! Get ahead of the trading game with Artificial Intelligence crypto trading software today!

A lot has changed since the last Bitcoin halving, which happened in 2020. For example, BTC’s price has surged four times. It even peaked at $69,000 in 2021 before crashing to $16,092 in 2022. But as of January 2024, the coin is trading above $44,000, all thanks to reputable firms injecting funds into the crypto market.

A Look at the Previous Bitcoin Halvings

The past three Bitcoin halvings have led to massive rallies. For instance, before 2012’s halving, BTC was valued at $12; a year later, the crypto asset rose to $960. In 2016, Bitcoin started the year trading at $660; after the halving event in July, the coin surged to $2,600. In 2020, BTC traded at $8,450 before the halving in May. In the months that followed, the largest cryptocurrency rallied to hit an all-time high.

For this reason, Bitcoin miners and investors should both pay attention to the upcoming Bitcoin halving. Bob Bodily, the brains behind Ordinals marketplace Bioniq, says more developers are now building projects on the Bitcoin blockchain ahead of the halving event as they anticipate massive adoption of the network.

It is important to mention that Bitcoin halving is not the only driver of the BTC rally expected over the coming months. Bloomberg ETF analysts expect the United States Securities and Exchange Commission to approve Bitcoin spot ETF this month. If that happens, the analysts anticipate institutional investors will pour more money into crypto.

Standard Chartered bank analysts argue that the halving event and the approval of Bitcoin spot ETF could cause BTC to hit $100,000 before this year comes to an end. MicroStrategy CEO Michael Saylor, whose company owns more than 180,000 BTC, is also bullish over Bitcoin this year. He believes institutional adoption of cryptocurrencies is imminent after the approval of Bitcoin spot ETF.

What Does Halving Mean for Bitcoin Price?

Will we see more retail investors buying Bitcoin as halving nears? Well, it is likely that they will continue accumulating their BTC holdings. But as for traditional investors, they may not step into the market until they see Bitcoin rallying.

Meanwhile, some analysts are convinced that the extreme volatility witnessed in Bitcoin over the years could be a thing of the past if an ETF is approved. They argue that the Bitcoin market will become more liquid due to increased capital flowing in, thus putting volatility under control.

Nishant Sharma, the man behind Bitcoin mining public relations company BlocksBridge Consulting, is optimistic that stocks of mining firms will also witness massive capital inflows this year from traditional investors who want exposure to Bitcoin without owning the coin.

With all said, the miners are likely to focus more on the halving than investors, considering that they will now have to increase their production to maintain their revenues after the event. This may put some mining firms out of business.

Disclaimer: Mining Plus Crypto specializes in amplifying content for dozens of cryptocurrency and blockchain firms, and your company could be next on the list! For inquiries, please reach out to us through or Telegram Chat. Given the unpredictable nature of cryptocurrencies, we advise you to thoroughly research before investing. A portion of the content available on our website, including broker reviews, is paid content or content contributed by guest writers and does not necessarily represent the opinions of Mining Plus Crypto. We claim no liability for the accuracy, quality, and content of advertisements, products, or any other materials, including ad spaces displayed on our site. For a comprehensive understanding, please review our full terms and conditions, and disclaimer.